There’s a never-ending debate among real estate investors about the best way to hold title to an investment property. Do you buy it in your name or use an LLC? This post won’t answer that question but it will highlight an unexpected benefit we just came across by having a mortgage in your own name vs. an LLC.

Using an LLC is typically the best way to protect a real estate investor from liability arising from an act or omission on the property. The purpose of the LLC is to isolate the liability to that asset and prevent a plaintiff from access assets the owner controls outside that LLC like personal assets or those in other LLCs.

Before we fully committed to growing our real estate portfolio, we purchased properties in our own name. Later we changed course and started buying in LLCs. Your attorney can help you transfer property to an LLC by paying recording fees to the registry of deeds.

Even when we use an LLC we purchase additional liability insurance on the property plus we have an umbrella policy in place if property-level liability limits are exceeded.

Our second BRRRR property was purchased in our own name. You can check out the before and after video tours below. We bought it in July 2019 for cash and obtained a mortgage in September 2019. Mortgage terms were a 5/1 ARM with a 30-year amortization at 4.25% rate.

Every mortgage includes a “due on sale” clause that says when the title to the property changes (i.e. it’s sold) then the mortgage must be paid off which makes sense – sell your home, pay off the mortgage, and keep what’s leftover.

But if you change the title from your own name to an LLC you control, the bank might also consider that a sale. So they could make you pay off the mortgage when the title is transferred. Normally as long as the mortgage is being paid, they don’t enforce this clause. But you can easily imagine a scenario where mortgage rates have risen and the bank has the opportunity to get their money back and re-lend it to someone else at a higher rate, increasing their profitability.

Immediately flipping a property into an LLC after you get a personal mortgage is sketchy and smells of fraud. Banks who lend to LLCs originate commercial mortgages where interest rates are higher, LTVs are lower, terms are shorter, and amortization periods are shorter than traditional residential mortgages made to individuals.

We waited over a year to put that property into an LLC and did it simultaneously with buying another unit in the same condo complex. The new unit was also purchased with cash (to entice the seller to sell to us) and we let it “season” for 6 months before doing a cash-out refinance.

The new unit, which was purchased in the LLC, received a commercial loan with 25% down with a 15-year term, adjustable every 5 years, on a 30-year amortization at 4.25%. That loan closed in May 2021.

To recap – we have two condos in the same LLC and both with mortgages at 4.25%.

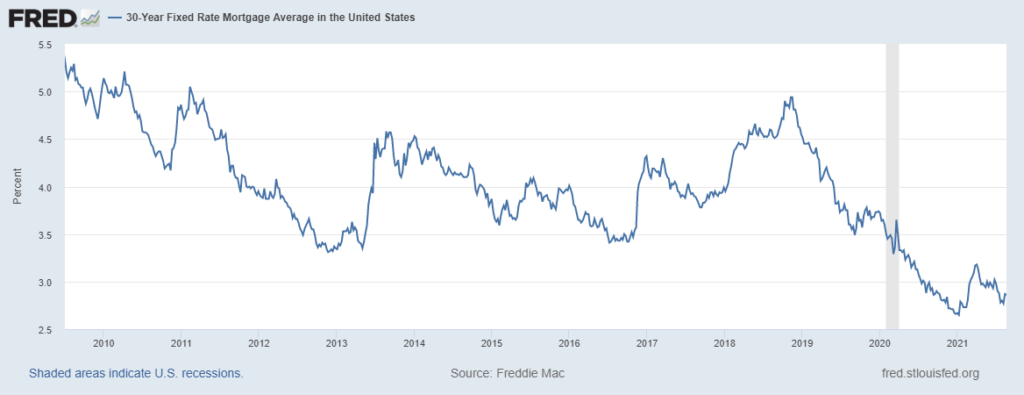

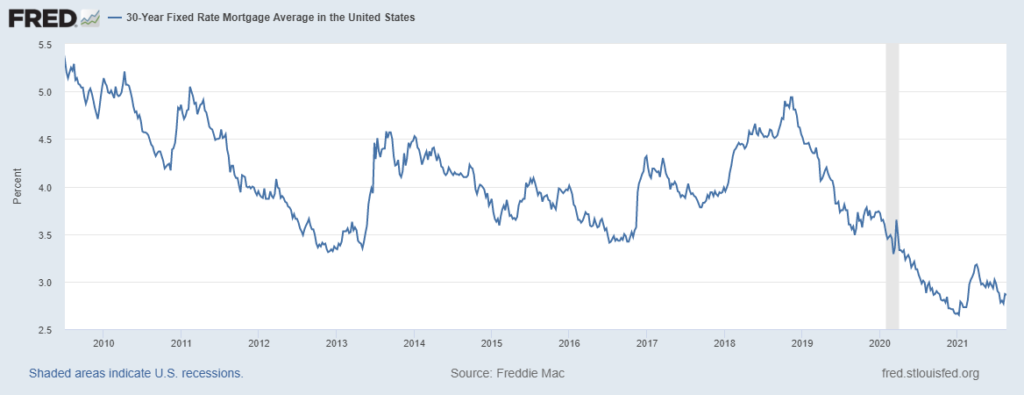

In June 2021, the bank on the first property offered us, unsolicited, an opportunity to modify the loan. For $1500 we could reduce our rate from 4.25% to 3.125% and turn the adjustable-rate mortgage into a fixed mortgage. A quick breakeven analysis revealed that the $1500 fee would be recovered in just 13 months through lower monthly payments. A HUGE WIN!

An unexpected benefit of having a personal mortgage on a property (only available when the title is held in your own name) is that the bank treats you like a person, not a corporation. They’d never do this on the commercial side where a business-to-business transaction takes place between two sophisticated parties.

When you have a personal loan with a bank – in this case, a small community bank – they want to keep you as a customer. The bank recognized that our 4.25% rate was high compared to the current market rates and we could easily refinance it with another bank. Instead of taking that risk, they’d rather keep a performing loan on their books and earn a $1500 fee.

From our perspective, we hadn’t bothered refinancing the loan because 4.25% was the market rate for a commercial loan so we couldn’t do any better. Sometimes keeping things simple is the way to go.