The 1% Rule of Thumb for Analyzing Investment Properties

How do you know if a deal is a deal?

The answer, of course, depends on your own personal preferences, financial goals, and risk tolerance. Luckily there is a shortcut or rule of thumb that can help get you a preliminary answer quickly.

But first, let’s look at the numbers. While purchase price is the most important number, you can’t fully evaluate a deal until you estimate several more. The astute investor will answer these questions with ballpark numbers that they can use to calculate return metrics like cash-on-cash return and capitalization rate.

Revenue

- how much are rents for comparable properties?

- what is the area’s vacancy rate?

Expenses

- how much are taxes?

- what operating costs does the landlord pay vs. the tenant?

- how much is insurance?

- what should I reserve for ordinary maintenance and repairs?

- how much will a property manager cost me if I don’t self-mange?

- what are the long-term capital expenditures I should save for?

- any immediate repairs I need to make upon closing?

Financing Expenses

- how much will I have to put down?

- what kind of interest rate can I get?

- how much are closing costs?

Ok, so what’s the easy way? The 1% rule.

You just need two inputs:

- purchase price – use the list price

- monthly rent – use actual rents (if unavailable, use comps from rented properties; if unavailable, use asking rents from current rental listings)

Simply multiply the purchase price by 1% or 0.01. The result should be close to the monthly rent. So a $100,000 property that commands $1000/month in rent hits the target. If rents were only $800, the property is not likely to generate enough income to cover the expenses.

That’s the point of the 1% rule – if you hit it, the property will likely produce cash for you to take home after paying all of the bills and setting money aside for future expenses like vacancy, maintenance, and capital expenditures.

The 1% rule is an approximation. Judgment and further projections will determine if it really a deal. If $800 rent is below market rate and you can get that to $1000 in two years, this could be worth the price tag.

All properties can meet the 1% rule by adjusting the price. Our home generating $800 in monthly rent doesn’t look good at $100,000 but it looks much better if you can get it for $80,000 or less.

Even in Massachusetts, you can find properties meeting the 1% rule. Blackacre constantly searches for these home for our investor clients. Here is a map of homes in Massachusetts listed between $100k and $200k that meet the 1% rule.

The purple circles indicate how many homes meet that criteria in a town. The green points are homes in other communities where they are an outlier.

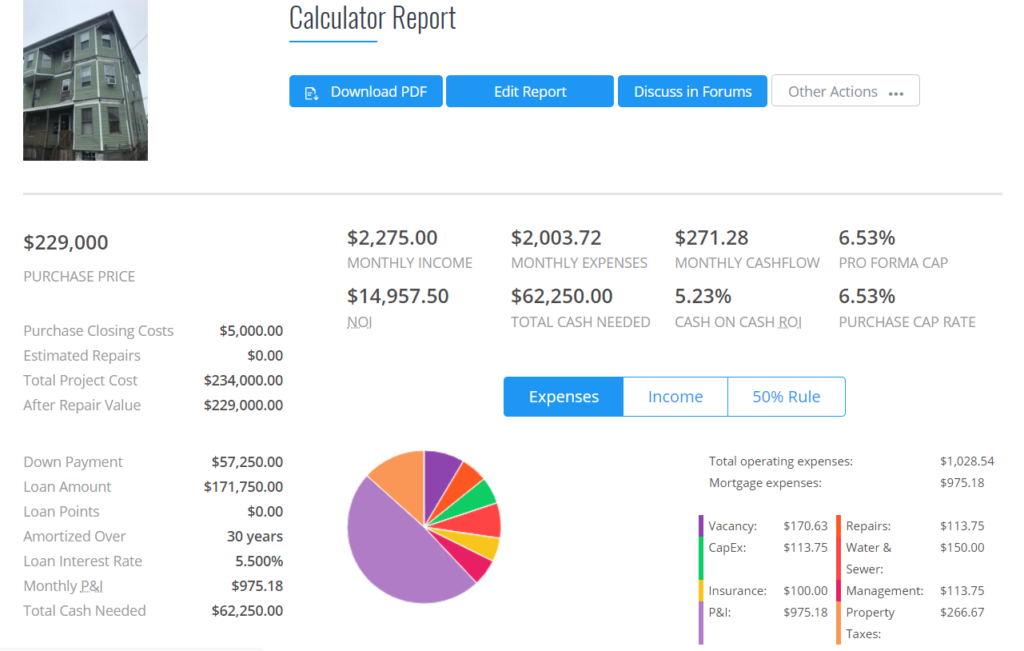

A Real Life Example

Property

- New Bedford, Massachusetts

- 3-Family

- Monthly rent: $2275

- Tax: $3200 per annum

- List Price: $229,000

Applying the 1% rule, this property falls short with $2290 as minimum rent under the 1% rule compared tp the $2275 actual rent.

Let’s check the numbers anyway in the BiggerPockets rental property calculator.

Assumptions:

- 25% down, 30-year fixed rate loan, 5.5% interest. Closing costs of $5000 rolled into the mortgage.

- 7.5% vacancy rate

- $2275 monthly rent (provided by the landlord in the listing)

- 5% of monthly rent to each: maintenance, capital expenditures, management

Results:

Despite missing the 1% target, the property does provide a nice positive cash flow. Monthly expenses are $2004 with $975 attributed to the mortgage expense. That produces $271 in monthly cash flow after carving out reserves for vacancy, maintenance, capital expenditures, and management.

The cash on cash return is 5.3%. This means the cash flow produces of $3252 annually is 5.3% of the $62250 down payment for the mortgage.

Consider that with savings rates at 1%, it would require $325,200 in a bank savings account to earn the same $271 per month. That’s 5x the investment in the 3-family.

Wait, there’s more!

This property is actually listed for only $189,900 boosting its cash-on-cash return to 10% and generating $438 in monthly cash flow.

Did you know?

Blackacre uses the 1% Rule to decide which properties to feature in the Blackacre Blog Multi-Family Investment Property Deal of the Week