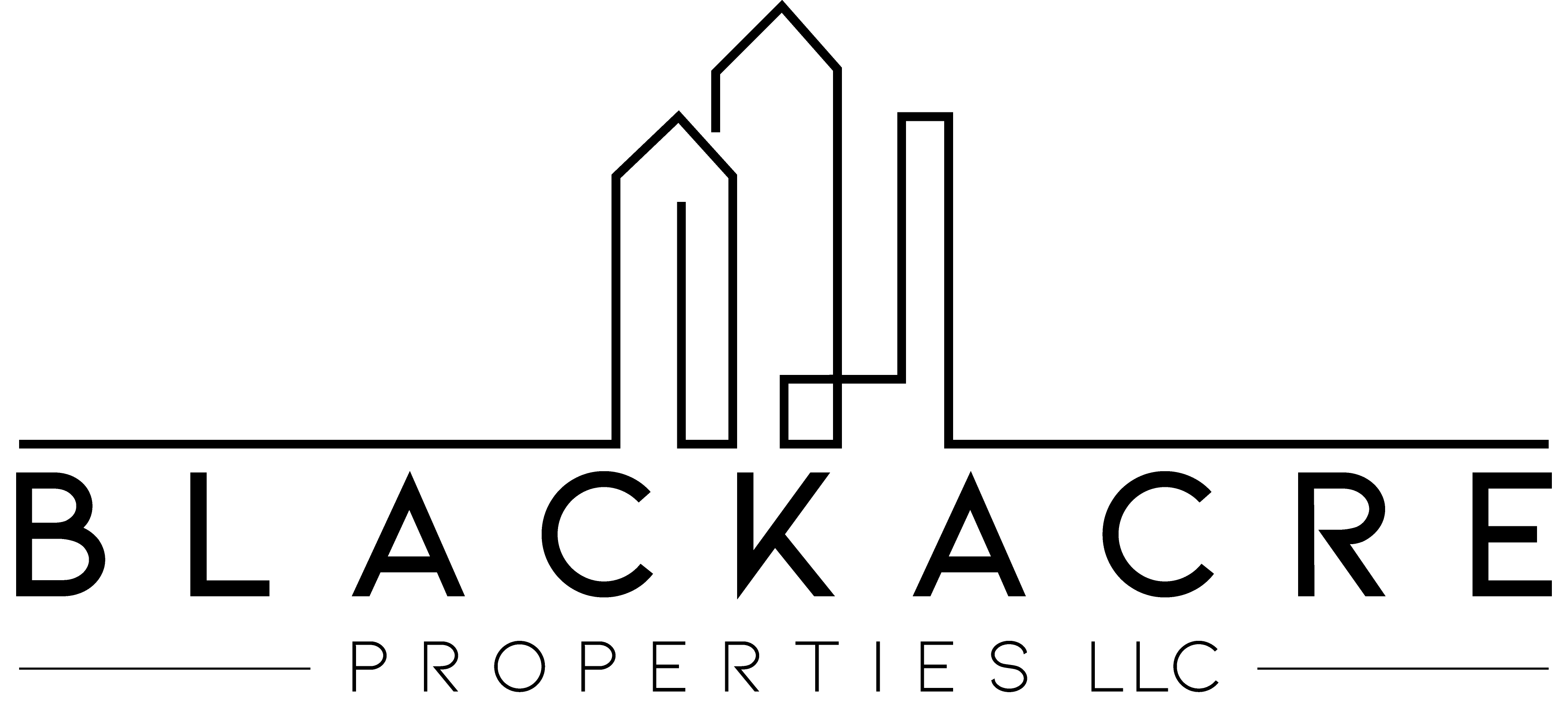

Cash offers aren’t nearly as popular as you think. We all hear stories about the all-cash buyer winning the property, but that fact of the matter is that nearly 90% of home buyers finance their purchase.

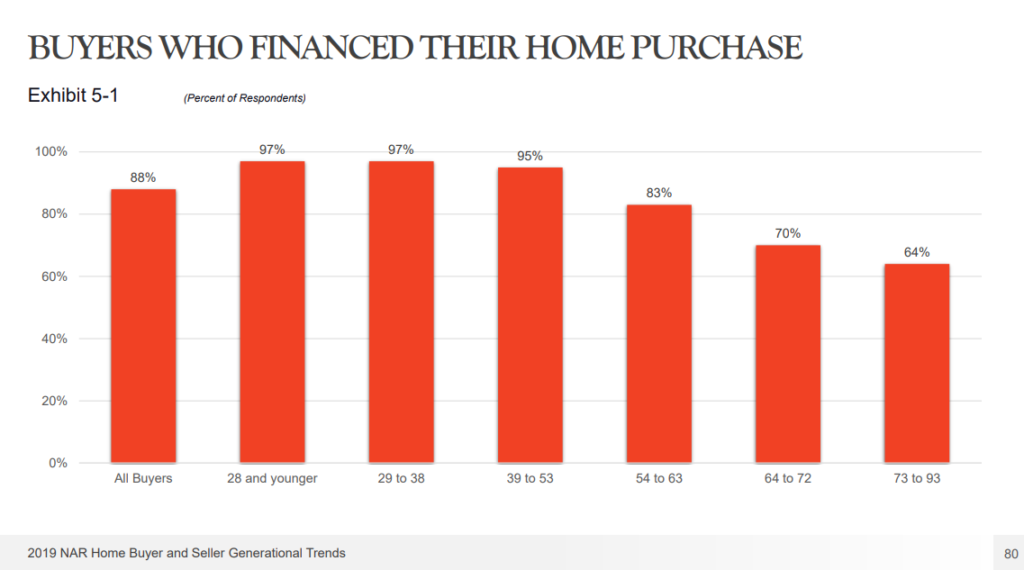

Furthermore, 20% down is a myth. There are plenty of financing options to buy a home with less than 20% down and the data proves it – the average down payment is 13% and just 6% for millennials.

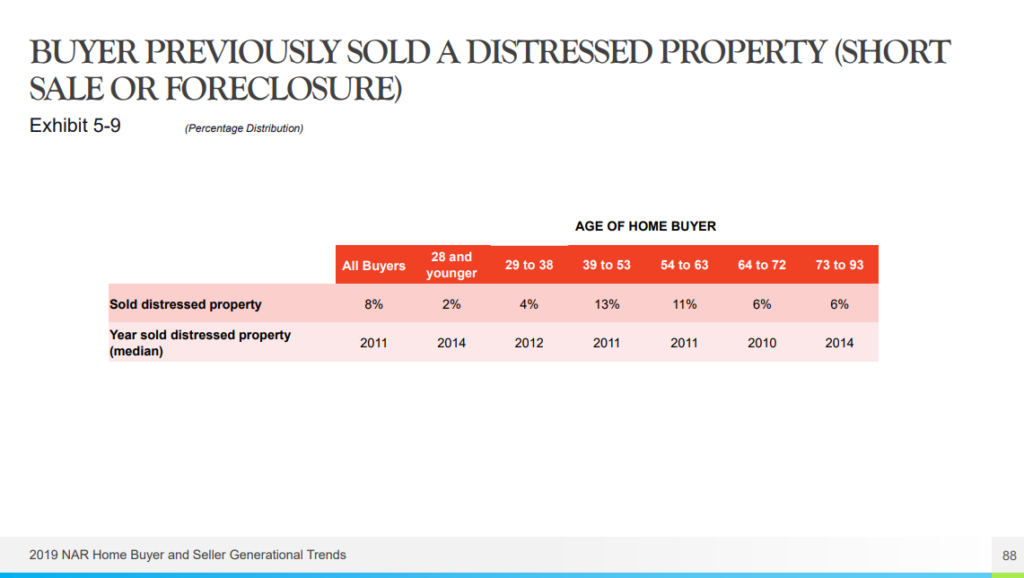

Buyers burned by the financial crisis are back. Looking at the age group that was most likely to own a home during the late 2000s – the 39-63-year-old group – 12% of buyers previously lost their homes to foreclosure or a short sale. Consumer confidence is strong when these folks are ready to buy again.

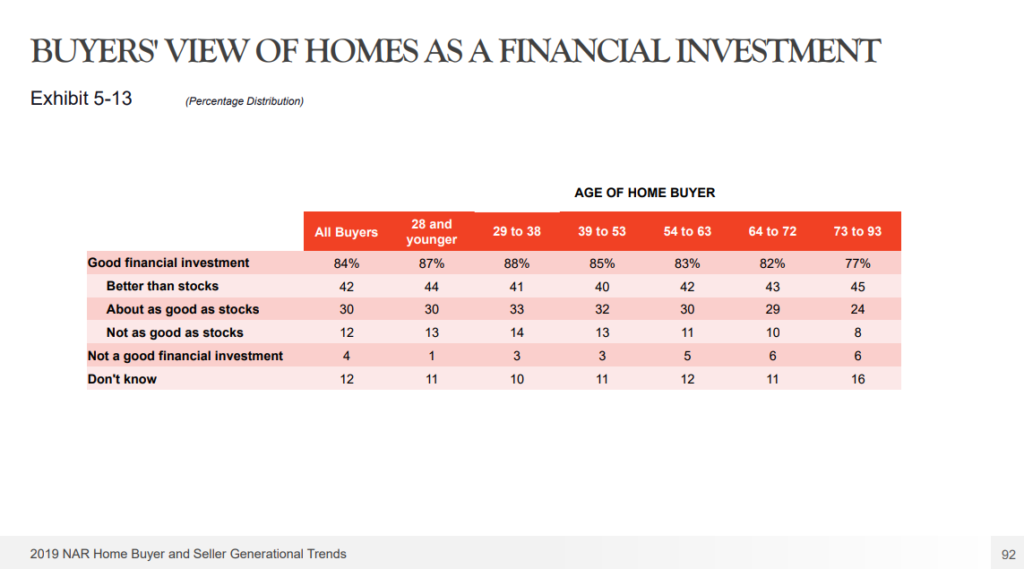

Given the strength of the housing market, it’s no surprise that over 80% of homebuyers consider it a good financial investment. The 42% who think it’s a better investment than stocks probably don’t realize the S&P 500 returned 31% in 2019. Rich Dad, Poor Dad would say that a home is only an investment if its a rental property generating income.

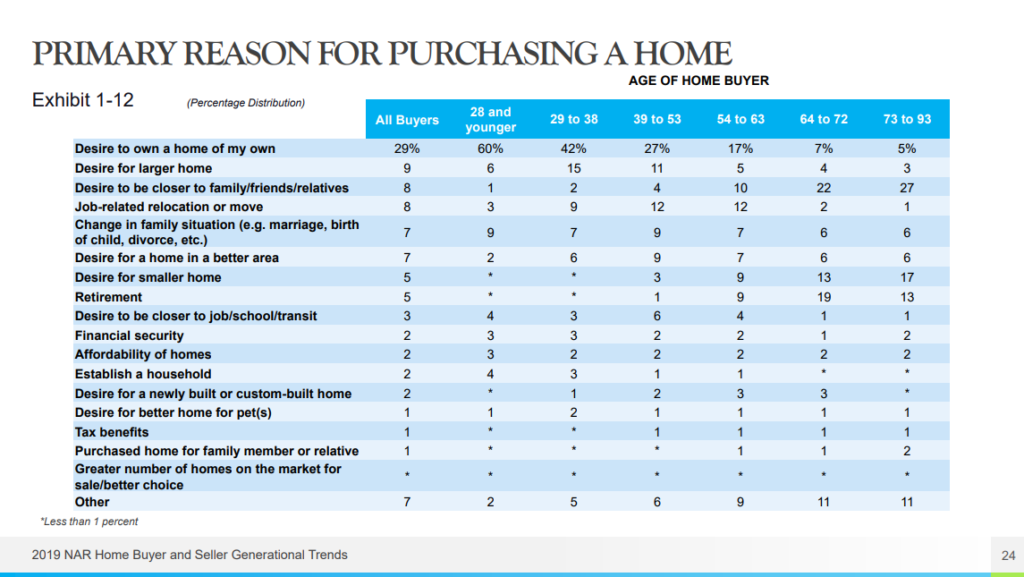

Even if homebuyers believe their home is a good investment, that’s not the reason they buy. They buy for emotional reasons: “I just want to own my own home” or “I just wanted a bigger home.” Barely registering on the list are financial reasons – financial security, affordability, and tax benefits.

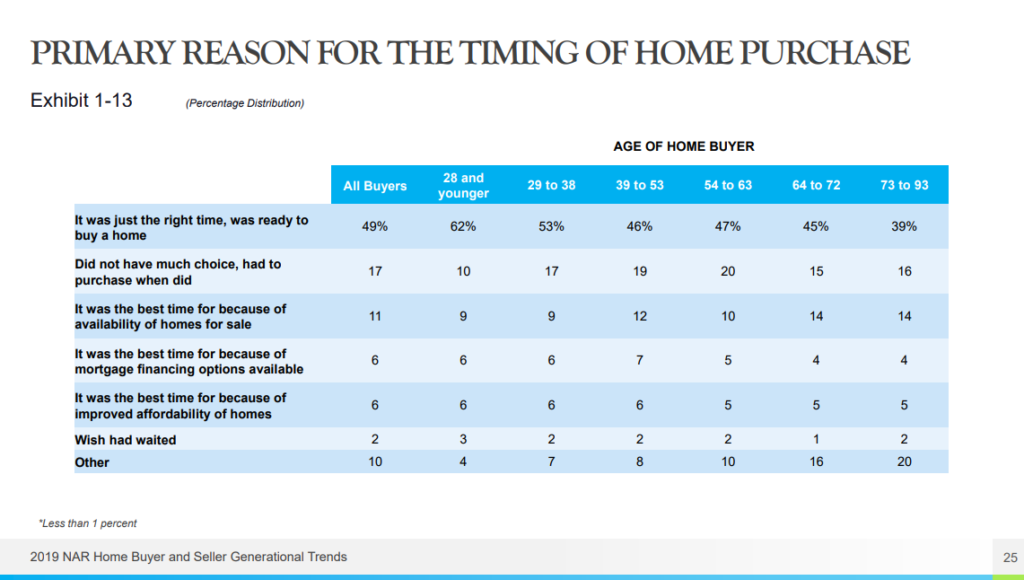

Along the same lines, the timing purchases are mostly influenced by emotional or practical reasons: “it was just the right time” or “did not have much choice, had to purchase when I did.” Capturing just 12% of the responses – financing options and affordability.

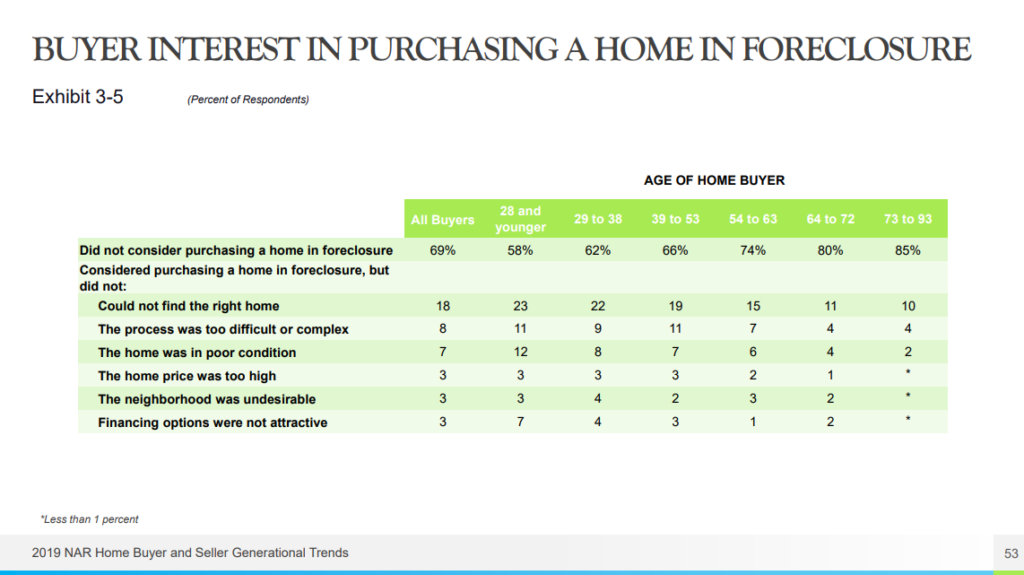

For BRRRR investors and flippers, the data below shows that competition from owner-occupants is low – only 30% even consider buying a foreclosure. For those considering house hacking and willing to do some repairs, a 203k loan is a good option for the homes others turn away because of their poor condition.

The full report from the National Association of Realtors 2019 Home Buyer and Seller Generational Trends.