The property and the negotiations

Last month we helped one of our investors get a 2-family property under contract. The 6-bedroom, 2-bath duplex is generating market rents with a pro forma cash-on-cash return of 17%, producing a 9% cap rate.

Our client had been looking in the area for a while and jumped at this property when it hit the MLS – it met his investment criteria nicely. We orchestrated an immediate showing, earnest money was delivered, and an offer was made just 2 days after listing.

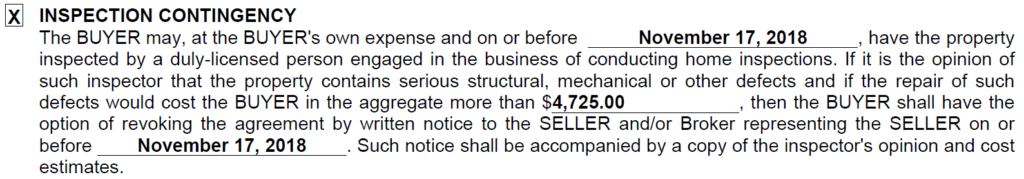

Our offer included a mortgage and inspection contingency – two of the most popular “out” clauses in an offer. Blackacre’s agent also

Maximum repair budget inspection contingency

We really like the maximum repair budget strategy and often couple it with an offer below list price. Here’s how it works: on a home listed for $200,000, we might offer $190,000 but put an inspection contingency that allows the buyer to back out only if estimated repairs exceed $5,000 (the buyer’s maximum repair budget).

Sellers know the power of a home inspection. If the inspector finds “serious structural, mechanical or other defects” the buyer has the option to revoke the agreement. Especially in a slowing market, the seller fears the home inspection blowing up the deal and having to start all over again.

Home inspections can create anxiety for sellers. What might they find? And how much negotiating leverage will that finding give the buyers? Blackacre often recommends our clients get a home inspection before listing to know exactly what might come up and potentially remedy those items in advance.

An inspection contingency without a repair threshold favors the buyer. In the example above, the amount would be $0 instead of $4725. The risk to the buyer is that, in a competitive market, their offer will be weaker.

On the other hand, a maximum repair budget assures the seller the deal will close as long as repairs don’t exceed the threshold. For this assurance, they will usually give up a little in terms of the asking price.

The tactic worked – the seller accepted our client’s offer – the property was under contract in just 3 days.

The home inspection

We always provide our clients with a few names of reputable home inspectors to choose from. They selected Gerry Verardo of Pioneer Valley Inspections. Gerry showed up early on inspection day and had already completed an exterior assessment by the time we arrived. Punctuality is always a good sign.

Right off the bat, Gerry was adding value. He identified an improperly poured concrete walkway that created a potentially dangerous slope. The slope created a slip and fall hazard which was amplified by the 2”x6” rectangular railing – an odd shape for gripping. He recommends a round railing to improve safety.

Inside, portions of the floor exhibited warping. The front sunroom had a significant “bounce” indicating possible deteriorated joists underneath. On a positive note, the ugly brown floors were actually just painted and maple hardwood hid underneath.

Gerry checked every electrical outlet with his outlet tester. That small device is able to tell if the wiring behind the walls is correct or not. For less than $10 it’s a worthwhile investment for real estate agents and house hunters.

Big problems in the non-living areas

Big problems were uncovered in the attic and basement.

Problem #1 – knob and tube wiring

Old school knob and tube wiring is a major concern. The process to remove it throughout the home is easily a $10,000 job. Furthermore, because most insurance companies will not underwrite homes with K&T, the seller may have to fix it before it sells. These antiquated systems can be a fire hazard.

Problem #2 – a fire in the

White rafters indicate fire damage. The wood was charred but not completely destroyed or unsafe. The white color was from a stain-blocking primer, likely used to seal the wood to mitigate the smell. But a few scratches with the finger showed black char underneath.

The entire roof had been replaced within the past 12 months which is one of the reasons the investor liked the prospects of the property. The fire wasn’t in the listing disclosures.

Problem #3 – termite and bear damage

Right in the middle of the home, large load-bearing support beams had significant termite damage. Some had holes all the way through. Gerry explained termites come in through the foundation and eat until they are stopped. There was no stopping these hungry guys.

And finally, three consecutive beams in the basement were chewed up – maybe from a pet bear? Or from someone practicing with their machete? Whatever the explanation, this is an unsafe condition.

Significant termite damage with a hole in the beam

Don’t even know how to explain this damage – what’s your best guess?

The math

This particular home inspection cost $450. The intelligence learned over the 2-hour inspection plus the 100-page detailed report informed our client’s decision to walk away.

Walking away

A $450 home inspection saved $41,250 which equates to a 90x return.

So that one simple tip – hiring a licensed home inspector may be your best investment all year.

In real estate, you need both good offense and defense. In this case, the defense won the game. Blackacre Properties LLC is your investment property coach and we’ll make sure you have the right specialists on the field for your next purchase.